Chamber News

At the Roseburg Area Chamber of Commerce it’s our priority to keep our members informed of any current legislation, member calls to action and upcoming events and programs. If you have any questions about current news please call 541-672-2648.

What’s on RACC's 2026 Oregon Legislative Agenda

The 2026 session officially began on February 2, with a mandatory adjournment deadline of March 8. The 35-day short session will move fast. With timelines tight for hearings and movement of bills out of committees, we can expect to see most policy bill discussions occur during the first week of the session, with tax bill discussions later in the session. Here are the bills the Roseburg Area Chamber is most closely watching for needed action:

SUPPORTING

SB 1510—Extend/expand Oregon’s expired “SALT cap workaround,” to allow Oregon businesses to lower federal tax burden in alignment with other states

SB 1514—Repeal or modify HB 3115, an outdated statute severely restricting local government’ ability to respond to unsanctioned public camping

SB 1586—Jobs, Opportunity and Build-Ready Sites Act (JOBS Act)

SB 1593 and HB 4071—Allowing recreational liability waivers except in cases of gross negligence (Read RACC Testimony in Support of SB 1593)

HB 4073—Administrative law reform, rulemaking transparency, outreach and criteria

HB 4105–Relating to reliable forest management outcomes–directs State Forester to establish sustainable harvest levels for timber on state forestland (Read RACC’s testimony in Support HERE)

OPPOSING

SB 1505—Home care labor/workforce standards boards

SB 1507—Imposition of vaguely detailed retail sales tax framework–Now the federal disconnect bill (Read RACC’s -4 and -5 Amendments Opposition Testimony Re Federal Tax Law Disconnect)

SB 1541—Climate change cost recovery measure (superfund program)

SB 1562 and HB 4148—Redirecting transient lodging tax (TLT) revenues away from tourism (intended use) (Read RACC’s Opposition Testimony of HB 4147)

HB 4015—Federal tax code disconnect, increasing tax burden on individuals and businesses

HB 4094—Mandatory accrued vacation time payout

HB 4098—Regulate insurance under Unlawful Trade Practices Act

HB 4134—Increase statewide transient lodging tax (TLT) to fund unrelated programs (Read RACC Opposition Testimony)

Please consider joining . . . WE HAVE!

Join the Coalition to Repeal HB 3115 (unsanctioned public camping law repeal)

Join the Coalition to Save Tourism Jobs (protect the intended/best use of transient lodging tax—TLT—funds)

Join Protect Oregon Recreation Coalition (damaging impact of Oregon’s Waiver Liability Standards to rec industry)

We encourage RACC members to utilize the Oregon Legislative Information System (OLIS) for the most current information about bill specifics and status of proposed legislation during the upcoming session.

Chamber to Advocate for Repeal of HB 3115

At its October meeting the Roseburg Area Chamber of Commerce board of directors voted unanimously to support any proposed legislation, initiative petition and ballot measure with the intent to repeal HB 3115 (ORS 195.530).

In 2021, the Oregon Legislature passed HB 3115, in response to a federal court case involving the authority of local governments to control unsanctioned camping. In 2024, the U.S. Supreme Court affirmed the authority of local governments to control unsanctioned camping. Unfortunately, HB 3115 restricts how local governments can address unsanctioned camping on public property.

On October 15, Oregon Business & Industry (OBI) filed an initiative petition, the “Local Control and Safety Act,” that seeks to repeal the 2021 Oregon law that prevents cities and counties from addressing unsanctioned camping. Repealing this law would allow communities to determine for themselves how to respond to the homelessness crisis in our streets and improve community safety.

It is OBI’s position, and Roseburg Area Chamber leadership concurs, that “HB 3115 should be repealed because the law prevents local governments from managing homelessness challenges in a manner consistent with their communities’ needs and expectations. The tent encampments that have arisen throughout Oregon have eroded community safety while compromising the dignity of homeless people themselves. Local governments lack the resources to provide sanitary services such as toilets and running water to unsanctioned encampments. Homelessness is a complex problem, and its causes and solutions vary from one place to another. To address it, local governments need the flexibility HB 3115 prohibits.”

OBI leadership believes there is an “opportunity to repeal HB 3115 during the 2026 Legislative Session. In a statement, OBI asserts the law has made Oregon’s homelessness crisis worse, not better, and polling shows consistently that Oregonians overwhelmingly want HB 3115 repealed or reformed. Oregonians need their legislators to repeal this failed law with the same urgency with which they adopted it in 2021. The filed initiative is a last resort, but election timelines and processes require the filing to occur now even while OBI and others seek a legislative solution.”

The RACC will actively support the repeal of HB 3115 during the 2026 session and, as/if needed during the initiative and ballot measure process. Look for more details and information in future “Chamber News” member emails, action alerts and Business Perspectives newsletters.

Grow Business-to-Business in 2026

$hop Chamber & $ave Program is a RACC Member-to-Member Exclusive. Sign up today!

There are so many reasons why it is great to be a member of the Roseburg Area Chamber of Commerce. We live here…we work here…we play here…we do business here…and most importantly, we love this community.

As part of the chamber, we all share a common goal, to see our local businesses succeed. We can accomplish this together! One of the ways we do this is through our $hop Chamber & $ave member to-member discount program. Build clients, customers and rapport in our business community and support other member businesses by shopping locally. To offer a chamber member-to-member discount in 2026 please check out the flyer, and email us if you have any questions.

The AI Revolution Isn’t Coming … It’s Here! Are You Ready For It?

For those who attended the chamber lunch on Monday, thank you for joining us for the AI & Your Business presentation. Tim and Pam loved the member interaction and the great questions you asked. As promised, they provided the following links to both the AI lunch presentation slide deck AND, also shared the AI bonus session slide deck. RACC members interested in receiving the link should email the business office ([email protected]) and request.

For those who attended the chamber lunch on Monday, thank you for joining us for the AI & Your Business presentation. Tim and Pam loved the member interaction and the great questions you asked. As promised, they provided the following links to both the AI lunch presentation slide deck AND, also shared the AI bonus session slide deck. RACC members interested in receiving the link should email the business office ([email protected]) and request.

As mentioned during the membership lunch, all Roseburg Area Chamber of Commerce members now have access to a free WhirLocal starter membership provided through RACC’s partnership with WhirLocal. Members can activate your free account here. As those in the bonus session learned, this membership which comes with four distinct AI assistants and so much more.

While certainly not necessary, members interested and ready to go further, you can upgrade to the accelerated membership for just $365/year or $37/month. This gives you access to an entire team of Smart AI Assistants (40+), like Kim for creating viral-worthy social media posts, plus additional tools to help your business grow, and a portion of every upgrade directly supports our chamber.

The sooner you activate your account, the sooner you can start saving time and getting better results with AI. We appreciate your participation and look forward to seeing how you put these tools to work in your business. Those who attended the September lunch also know you can reach out to Tim and Pam directly at WhirLocal with your AI questions!

A Standing Ovation for Future Community Leaders

The Roseburg Area Chamber of Commerce celebrated the graduates from its 2024-25 Project Leadership Roseburg program, and one from last year’s class, at its May 19 membership lunch. The leadership program challenged participants to not only increase their knowledge about Roseburg and Douglas County, but to also become more actively engaged and involved in our community.

These community-minded leaders have dedicated the last nine months to learning more about our community and the importance of service. They will do great things through volunteerism for the betterment of Roseburg and Douglas County for years to come. Please join us in our standing ovation and congratulate our Project Leadership Roseburg graduates: Brian Betz, Sunrise Enterprises; Brittany Burke, Umpqua Bank; Ashley Gill, Roseburg Forest Products; Justin Moon, Mercy Medical Center; Amy Nytes, City of Roseburg; Theresa Roche, WorkSource Douglas/Oregon Employment Department; and, Abigail Willis, Umpqua Community College.

Congratulations to our Project Leadership graduates! Thank you for your commitment to the leadership program and your dedication to our community. Each of you shines brightly in your own individual way. Your brilliance will light the way to a brighter future for our community!

All of us at the chamber want to thank this year’s generous leadership program sponsors: Douglas County, Evergreen Family Medicine, FCC Commercial Furniture, Lone Rock Resources and Roseburg Forest Products. We couldn’t do what we do without you!

The chamber’s 36th year, 2025-26 Project Leadership Roseburg, will begin on September 11, 2025. The application period has closed.

The Wait is Over . . . The Celebration Continues!

April 14, 2025 Today, at the Roseburg Area Chamber of Commerce April membership meeting lunch, Tabbitha Layman was named our 2024 First Citizen! Like her fellow 2024 First Citizen recipient, Dan Bain, Tabbitha was recognized for years of giving her time, talents and dedication volunteering in our Roseburg and Douglas County community.

April 14, 2025 Today, at the Roseburg Area Chamber of Commerce April membership meeting lunch, Tabbitha Layman was named our 2024 First Citizen! Like her fellow 2024 First Citizen recipient, Dan Bain, Tabbitha was recognized for years of giving her time, talents and dedication volunteering in our Roseburg and Douglas County community.

She is an active Rotarian, previously serving as board chair; a Festival of Lights committee member, chairing that annual event as well. She serves on the Greater Douglas United Way board of directors, has served on the Dave Johnson memorial golf tournament committee, served as a CASA advocate and supported numerous other local organizations and events. She is involved in numerous committees and organizations in her hometown of Sutherlin. She is a Roseburg Area Chamber of Commerce Project Leadership graduate and a current member of the board of directors.

Read 2025 RACC board chair Jami Seal’s introduction of our 2024 First Citizen, Tabbitha Layman HERE! Check out the complete, updated 2025 annual awards and meeting of the membership event press packet.

Tonight, We Celebrate!

March 20, 2025 Tonight, the Roseburg Area Chamber of Commerce’s 70th annual awards dinner and meeting of the membership shined a light on amazing local businesses and community leaders and celebrated chamber activities, accomplishments, priorities and leadership (past and present). Included in the celebration was honoring long-time Roseburg “Icon” Dan Bain as our 2024 First Citizen. Business of the year honors for 2024 went to Girardet Wine Cellar, Sunrise Enterprises, Inc. and Umpqua Dairy. For more information, check out the evening’s Program and get more details and highlights about the evening’s festivities HERE.

March 20, 2025 Tonight, the Roseburg Area Chamber of Commerce’s 70th annual awards dinner and meeting of the membership shined a light on amazing local businesses and community leaders and celebrated chamber activities, accomplishments, priorities and leadership (past and present). Included in the celebration was honoring long-time Roseburg “Icon” Dan Bain as our 2024 First Citizen. Business of the year honors for 2024 went to Girardet Wine Cellar, Sunrise Enterprises, Inc. and Umpqua Dairy. For more information, check out the evening’s Program and get more details and highlights about the evening’s festivities HERE.

The chamber’s 70th annual awards dinner was generously sponsored by Acrisure Northwest and Lone Rock Resources.

Oregon 2025 Legislature: RACC Issues, Positions & Actions

Keep current on the issues facing business during the 2025 Oregon Legislative Assembly and the Roseburg Area Chamber’s advocacy on behalf of Douglas County businesses. Information is updated weekly, at a minimum, so check back regularly for:

Chamber Launches Legislative Agenda to Protect Business Interests

At its November meeting the Roseburg Area Chamber of Commerce board of directors unanimously approved the organization’s 2025-26 Public Affairs & Legislative Agenda. Following 2024, a year where the chamber’s defense of business was vast and varied from local issues such as supporting the city’s UGB land swap to advocating for and against legislation to Congress and during Oregon’s 2024 Legislative Session; the unfortunate U.S. Supreme Court, denying hearing on the chamber’s Amicus Brief to the successful defeat of Measure 118 and election/re-election of all chamber-endorsed candidates. The chamber’s legislative and public affairs agenda for the next two years is expansive, takes on new issues and, as always, is laser-focused on defending and protecting our local business interests.

If issues arise during the 2025 Oregon Legislative Session that may adversely impact specific industries or business overall, please let us know before the matter gets to public hearing, so the chamber can take appropriate action, if needed. Please take a moment to read the chamber’s 2025-26 Public Affairs & Legislative Agenda online.

Congress Urged to Pass Emergency Relief Supplemental

The Roseburg Area Chamber of Commerce joined with a coalition of state and local chambers of commerce through the US urging Senate and House Leadership to expeditious pass an emergency supplemental appropriations bill during the upcoming Congressional work period to replenish funding for disaster relief programs that have been or are at threat of being exhausted as a result of recent natural disasters. Read the November 12, 2024 coalition letter HERE.

Chamber Urges Congress to Pursue Pro-Growth Tax Policy

The Roseburg Area Chamber of Commerce joined more than 500 state and local chambers and national trade associations in calling on the next Congress and administration to pursue a pro-growth agenda and prevent tax increases on American families and businesses.

In 2017, pro-growth tax reforms were enacted to invigorate our economy, bringing significant benefits to families and local businesses nationwide. These changes sparked new companies, fueled pay raises for workers, and opened job opportunities as employers reinvested in their communities. Without decisive action from the next Congress and administration, many of the pro-growth tax reforms enacted in 2017 will automatically vanish at the end of 2025.

The coalition letter, from chambers and organizations from every state in the U.S., was sent to Capitol Hill on Thursday, September 12. Read the letter HERE.

ARCHIVED NEWS

Archived News (11/18/2025)

The State of the State's Economy, Competitiveness & Business Climate

GET TICKETS! The Roseburg Area Chamber’s last membership meeting of 2025 will host a program on the state of our state’s economy. The presentation will focus on the state of business in Oregon including a recent analysis of Oregon’s regulatory impacts on business and other factors resulting in Oregon’s plummeting business ranking in the US.

GET TICKETS! The Roseburg Area Chamber’s last membership meeting of 2025 will host a program on the state of our state’s economy. The presentation will focus on the state of business in Oregon including a recent analysis of Oregon’s regulatory impacts on business and other factors resulting in Oregon’s plummeting business ranking in the US.

Presenting the November membership meeting lunch program will be Oregon Business & Industry president and CEO, Angela Wilhelms. In addition to the above, Angela will also provide a brief discussion on an OBI initiative to repeal ORS 195.530 (HB 3115) related to restrictions on local governments’ ability to manage and enforce unsanctioned public camping. She is also expected to share what business may expect to see in the upcoming 2026 Oregon Legislative Session.

Chamber membership lunch meetings are held at the Douglas County Fairgrounds Complex in the Community Conference Hall from 11:45 am to 1 pm. The lunch buffet opens at 11:45. Advanced ticket purchase is required to attend. Online ticket sales only; tickets are not available at the door. The deadline to purchase your tickets is Wednesday, November 12.

The chamber’s November membership meeting lunch program is generously supported and sponsored by Pacific Power.

Archived News (10/20/2025)

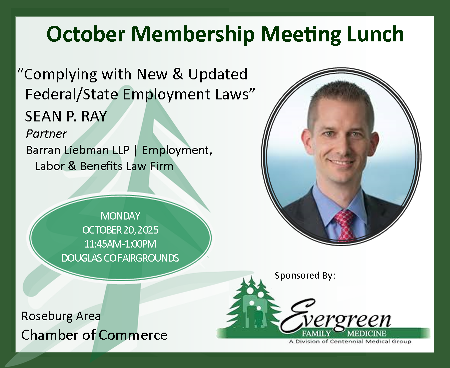

Keep Compliant with New and Updated State & Federal Employment Laws

GET TICKETS! There have been noteworthy changes in 2025, with more to come 2026, to both federal and state employment/labor laws. Oregon employers face new regulations regarding leave, pay equity and hiring practices, with penalties for non-compliance growing stricter. These updates affect our local employers, from rules about internal investigations and age discrimination to new liability mandates for contractors. Employers should attend the Roseburg Area Chamber’s October 20 membership meeting lunch for important information about keeping in compliance with new and updated state and federal laws.

GET TICKETS! There have been noteworthy changes in 2025, with more to come 2026, to both federal and state employment/labor laws. Oregon employers face new regulations regarding leave, pay equity and hiring practices, with penalties for non-compliance growing stricter. These updates affect our local employers, from rules about internal investigations and age discrimination to new liability mandates for contractors. Employers should attend the Roseburg Area Chamber’s October 20 membership meeting lunch for important information about keeping in compliance with new and updated state and federal laws.

Presenting at the October membership lunch will be Sean Ray, a partner with Barran Liebman, LLP. Barran Liebman is an employment, labor and benefits law firm in Oregon. Mr. Ray specializes in representing management in complex employment matters and high stakes litigation. He defends employers against discrimination complaints, sexual harassment lawsuits, and retaliation claims, wage and hour claims, and represents employers in state and district court, as well as before Oregon’s Bureau of Labor and Industries (BOLI). He regularly presents to chambers of commerce and other business organizations around the state on employment law and labor matters.

Chamber membership lunch meetings are held at the Douglas County Fairgrounds Complex in the Community Conference Hall from 11:45 am to 1 pm. The lunch buffet opens at 11:45. Advanced ticket purchase is required to attend. Online ticket sales only; tickets are not available at the door. The deadline to purchase your tickets is noon on Wednesday, October 15.

The chamber’s October membership meeting lunch program is generously supported and sponsored by Evergreen Family Medicine.

Archived News (9/30/2025)

Request 2025 Shop Chamber & Save Discount Cards

RACC Member-Exclusive Offer! Members of the Roseburg Area Chamber of Commerce have the opportunity to participate in our annual special member-to-member “Shop Chamber & Save Program!” Each year, chamber member businesses offer discounts to fellow chamber members to build rapport in the business community, increase exposure and grow their business.

See the list, so far, of participating chamber members and their 2025 “shop chamber & save” offers. If you have not yet requested discount cards, send an email to [email protected] and request 2025 discount cards for you and your employees. Some restrictions apply.

Support local businesses and your fellow chamber members and save money! Request your discount cards today!

Archived News (6/30/2025)

Chamber Supports City’s Proposed UGB Swap

At the March 19 meeting, the Roseburg Area Chamber of Commerce voted unanimously to support the city of Roseburg’s proposed Urban Growth Boundary (UGB) swap. For details about the chamber’s position, please see the chamber’s letter of support.

Archived News (5/31/2025)

UPDATE: Corporate Transparency Act (CTA) Filing Requirement SUSPENDED

March 5, 2025 UPDATE From the U.S. Chamber of Commerce: The Corporate Transparency Act’s (CTA) beneficial ownership reporting requirements have been suspended for U.S. citizens and reporting companies.

Here’s What Happened: The Treasury Department announced that it will not enforce any penalties or fines associated with the BOI reporting rule for U.S. reporting companies. The Treasury Department will be issuing a proposed rulemaking that will narrow the scope of the rule to foreign reporting companies only.

Now, after numerous delays and legal challenges, U.S. small businesses will not be fined or penalized if they do not file their paperwork by the extended deadline previously announced by Treasury’s Financial Crimes Enforcement Network (FinCEN) of March 21, 2025.

The Lastest Court Rulings: A federal court in Michigan ruled on March 3 that the Corporate Transparency Act violates the Fourth Amendment to the U.S. Constitution. The court issued a limited injunction blocking the law’s enforcement against challenger plaintiffs and their business members, including the Small Business Association of Michigan and the Chaldean American Chamber of Commerce.

To learn more and keep up to date on the Corporate Transparency Act (CTA) download the U.S. Chamber’s User Guide HERE.

February 21, 2025 UPDATE: Corporate Transparency Act (CTA) Filing Requirement BACK ON A federal court recently lifted the injunction that stopped the Department of the Treasury from requiring businesses to file beneficial ownership information as required by the Corporate Transparency Act (CTA). After numerous delays from pending legal challenges, certain small businesses now have to file their paperwork as early as March according to an update from the federal government’s Financial Crimes Enforcement Network (FinCEN), which stated, “For the vast majority of reporting companies, the new deadline to file an initial, updated, and/or corrected BOI report is now March 21, 2025. FinCEN will provide an update before then of any further modification of this deadline, recognizing that reporting companies may need additional time to comply with their BOI reporting obligations once this update is provided.”

Earlier this month, the House of Representatives passed a one-year delay for small businesses from having to report their beneficial ownership information under the CTA. The U.S. Chamber of Commerce is working to get this much-needed small business relief passed by the U.S. Senate. Keep up to date with the CTA filing status and deadline(s) and download the U.S. Chamber’s User Guide on the CTA developed to assist our businesses.

December 4, 2024 UPDATE: CAT Filing Requirement Blocked Last week, the Roseburg Area Chamber shared information and a toolkit from the U.S. Chamber of Commerce to assist businesses with their Corporate Transparency Act filing. Yesterday, a federal court in Texas issued a nationwide injunction halting the implementation of the Corporate Transparency Act’s (CTA) beneficial ownership reporting requirements. Therefore, unless and until an appellate court overrules or narrows the injunction, no businesses are obligated to comply with the reporting requirements.

According to the U.S. Chamber, the Texas court halted implementation of the CTA beneficial ownership reporting requirements, holding that the CTA is likely unconstitutional, and issued a preliminary injunction barring the government from enforcing the CTA and its reporting requirements against anyone. This is important since prior to the ruling, small businesses that met certain criteria would have had to file reports with the Department of the Treasury by January 1, 2025, or risk fines and criminal penalties. As it stands now, the preliminary relief will remain in effect until the conclusion of legal proceedings, at which point the court may enter a permanent injunction. In the meantime, the government will likely appeal the preliminary injunction.

We will keep our members updated on the status of the CTA matter. Find more information about the Corporate Transparency Act below.

Toolkit for Corporate Transparency Act (CTA) Filing

CORPORATE TRANSPARENCY ACT FILING DEADLINE IS JANUARY 1. In response to confusion by local chambers and their business members, the US Chamber of Commerce developed an online tool to help businesses comply with the Corporate Transparency Act (CTA). While the US Chamber is working on an effort to delay the January 1 CTA filing deadline, they also want to make sure our members have the tools needed to be in compliance with the CTA should their effort fail. Not filing by the deadline puts small business owners at risk of fines and criminal penalties. Therefore, the US Chamber has developed a step-by step guide, free to our members to help complete the necessary reports

The law was enacted in 2021 to combat illicit activity, including tax fraud, money laundering, and terrorism financing, by capturing more ownership information for specific U.S. businesses. Businesses must provide their legal name and trademarks, as well as their current U.S. address. They’ll also need to provide a taxpayer identification number and specify the jurisdiction where they were formed or registered. Find more information from the US Chamber of Commerce about the Corporate Transparency Act HERE. Download the CTA Toolkit today.

Archived News (4/30/2025)

Measure 118 is Defeated!

A huge THANK YOU to our members and local business community! Thank you for responding to the Roseburg Area Chamber’s “Calls to Action” on Measure 118. Thank you for being some of the first businesses, organizations and individuals to join the “NO on 118/Defeat the Costly Tax on Sales” Coalition. Thank you for financial support, posting signs, spreading the word and VOTING! The overwhelming defeat of M118 is a credit to you and a success belonging to and for Oregonians!

Archived News (4/30/2025)

Chamber Comments on DEQ’s 2024 Climate Protection Program (CPP) Draft Rules

The Oregon Department of Environmental Quality (DEQ) is accepting public comment on its Climate Protection Program.

In 2023, the Oregon Court of Appeals struck down the Department of Environmental Quality’s (DEQ) Climate Protection Program (CPP), which would have raised energy prices for Oregonians, including our businesses, hospital and schools. Now, the agency is back with the same costly program and is seeking public comment on the draft rules.

While the program’s environmental goals are commendable, the financial burden on our local businesses, organizations, residents, and all Oregonians should not be overlooked. The CPP will lead to increased energy costs for consumers, putting a strain on budgets that are already stretched too thin.

The Oregon DEQ acknowledges in their own draft Fiscal Impact Statement that compliance costs for fuel suppliers, including natural gas utilities, will likely be passed on to consumers. In the same document, they maintain this could disproportionately impact businesses, industries, and low-income households and rural areas like Douglas County, which may face challenges transitioning to clean energy and are less resilient to price increases. Regardless, they continue to push forward with the program.

Energy cost increases are also anticipated for other large natural gas customers like local hospitals, manufacturers, and schools, since the rule contains no cost caps.

On August 26, the Roseburg Area Chamber of Commerce submitted its comment letter to the Oregon DEQ regarding its proposed CPP. Read RACC Comment Letter.

The deadline to submit comments to the DEQ is September 27 at 4:00 pm. Send a message to the DEQ urging them to consider the economic impact this program will have on Oregonians.

Archived News (3/31/2025)

Elin Miller & Guy Kennerly Are Our 2023 First Citizens!

The Roseburg Area Chamber of Commerce held its 69th annual awards dinner and meeting of the membership on March 21, 2024. Leadership announced the organization’s executive team for 2024, the chamber’s activities and accomplishments for 2023, and highlighted some of the organization’s key priorities for this year. Each year the chamber looks forward to its annual celebration of our business community and the opportunity to recognize business excellence and distinguished volunteer service of outstanding local citizens.

The Roseburg Area Chamber of Commerce will be led by the following executive leadership team in 2024: Chelsea Buckbee of Rogue Credit Union, chair of the board; Jeff Schwendener, Avista Utilities, vice chair; chamber president & CEO Debbie Fromdahl, board secretary; Jami Seal, Lone Rock Resources, treasurer; and, immediate past chair Tammy Turner from the Community Cancer Center, as the five corporate officers for the organization.

Each year, Roseburg Area Chamber of Commerce priorities focus on its core responsibility to serve, promote and protect the businesses of Douglas County. The chamber will continue to represent the interests of business through political advocacy; its work to create a strong local economy; promote the community and our member businesses; and, of course, provide the quality programs chamber members have come to expect. Specifics about the chamber’s activities and accomplishments for 2023 and the organization’s key priorities for 2024 are detailed on the chamber’s website.

During the evening’s festivities, the Roseburg Chamber honored four local organizations for their excellence in business. The 2023 small business of the year recognition went to Roseburg’s Community Cancer Center. Abby’s Legendary Pizza was honored as the chamber’s medium-size business of the year for 2023, with Roseburg Forest Products receiving large business of the year honors. Aviva Health was awarded the chamber’s Excellence in Business Innovation recognition.

The highlight of the chamber’s awards dinner is the annual naming of its First Citizens. Elin Miller and Guy Kennerly received the chamber’s 2023 First Citizen honors for their years of volunteer service and unwavering commitment to our community. Miller was recognized for her service to the youth and young adults of Douglas County and our agricultural community. She previously served on the board and as president of Umpqua Community Development Corp. She served on Umpqua Bank’s divisional board and UCC’s Board of Education. She currently serves on the boards of UCC Foundation, Community Cancer Center, Forest Bridges, the Oregon Wine council, where she is a past board president and Oregon’s Future Farmers of America Foundation board, as its immediate past president. Elin was appointed to Oregon’s Board of Agriculture in 2020, by Gov. Kate Brown. In addition to her consulting firm, Elin, and her husband Bill, have a hazelnut farm—UmpquaNut Farm—and, and a vineyard.

Kennerly was recognized as a “true community servant.” His involvement includes serving on the boards of Douglas County Farmers Co-op, Cascade Community Credit Union and UCC’s Board of Education. He is the longest serving board member for the Community Cancer Center. Guy’s past volunteerism includes the Douglas County Industrial Development Board, Douglas County Planning Commission, Winston-Dillard School District Board and the Roseburg Area Chamber board of directors. He is active with Partnership for Umpqua Rivers, Oregon Sheep Growers Assn, Douglas County Livestock Assn, Rotary Club and local 4-H and FFA livestock auctions, to name a few. Guy owns Umpqua Insurance Agency and Umpqua Valley Tractor.

For more about our incredible honorees, take a look at RACC’s “Press Packet” for the event and check out pictures of our honorees on Facebook and Instagram. The annual awards dinner program is also available for viewing and download. The chamber’s annual awards dinner and meeting of the membership was generously supported by the evening’s title sponsor Cascade Community Credit Union and corporate sponsors Lone Rock Resources and Acrisure Northwest/Umpqua Insurance Agency.

Archived News (3/31/2025)

Chamber Celebrates 2023 Business Excellence

At the Roseburg Area Chamber of Commerce’s 69th annual awards dinner and meeting of the membership on March 21, the chamber recognized four local organizations for their business excellence.

The Roseburg Area Chamber of Commerce annually honors member businesses that have made a substantial contribution to the community for the last five years or longer; have employees who individually or collectively participate in the community; and/or, the physical presence of the business adds to the economic vitality and livability of our community. All three of our 2023 “Business of the Year” recipients, are organizations that never waiver in their commitment to innovate. Despite any challenges they remained focused on growth, building new or renovating existing facilities and expanding their operations; investing in their organizations, employees and community. These companies’ commitment and investment contributes to the economic vitality of Roseburg and Douglas County.

The chamber’s 2023 “Small Business of the Year” honor was awarded to the Community Cancer Center. The Community Cancer Center has been part of our community for 45 years. But, not just part of our community; this organization was created by and for the service of our community. In 1979, a group of local citizens met, a non-profit corporation dedicated to providing patients diagnosed with cancer a local option of high-quality radiation therapy services, was formed, and Roseburg’s Community Cancer Center was born. From its small building beginnings on Umpqua Street to the 44,000 square foot facility we know today, built in 2009 largely through community donations, our Community Cancer Center has provided effective and compassionate cancer care to our citizens with H.E.A.R.T.—Honesty, Excellence, Accountability, Respect and Teamwork . . . HEART!

The chamber’s 2023 “Medium-Size Business of the Year” accolades went to Abby’s Legendary Pizza Abby’s Legendary Pizza has been a culinary staple in this community for 60 years. It all started in July of 1964 when two long-time friends and high school classmates, Albert Broughton and James Harrell (better known as Abby and Skinny), opened the doors of the very first Abby’s Pizza Inn on N.E. Stephens in Roseburg, Oregon. It wasn’t long before word of Abby’s spread like melted mozzarella cheese throughout the region, and the legend, was born. From its infancy until today, our Abby’s has been the “go-to-place-to-be” before or after the game, kids’ birthday parties, family and classmate reunions and just a great place for lunch or dinner, dine-in or takeout! In January of 2021, Abby’s was purchased and is now wholly owned by Lone Rock Resources. Abby’s has 37 locations throughout Oregon and Washington, with the newest location in Prineville Oregon. Thankfully, five of those locations are right here in Douglas County!

Chamber honors went to Roseburg Forest Products for its 2023 “Large Business of the Year.” Founded in 1936 in Roseburg by forest products pioneer Kenneth Ford, passion for wood is the company’s spirit and its legacy. For nearly 90 years, Roseburg Forest Products has not just been a standout leader in its industry, but a name and business synonymous with our community. Roseburg’s long-standing support of local non-profits, capital campaigns, youth programs and more, is immeasurable. Roseburg’s investment in our community from infrastructure to educational and workforce training programs is long-standing. It is a company whose leadership believes in our community, our citizens and our businesses and organizations. This may never have been more evident than last year, when Roseburg announced its planned $700 million dollar investment to upgrade and expand its manufacturing operations in Southern Oregon, primarily in Douglas County. The total project represents the largest ever known investment in manufacturing in rural Oregon, and one of the largest private capital investments of any kind in our state’s history.

The 2023 “Business Excellence in Innovation,” went to Aviva Health. Aviva Health began seeing patients in 1991 as the Open Door Clinic, the effort of a community task force intent on providing health care for the underserved. Located on Pine Street, the clinic provided 1,241 visits that first year. Aviva Health became a Federally Qualified Health Center, or FQHC in 1999. A community health center is a non-profit healthcare practice that provides high-quality, cost-effective primary healthcare to anyone seeking care, regardless of their insurance status or ability to pay. Aviva Health has grown to six service locations, providing primary medical, dental and behavioral health services. Aviva recognized the need to address our community’s healthcare provider crisis, and that recruitment and retention of qualified healthcare workers in Douglas County was an ongoing challenge. They decided an innovative approach to create a pipeline of healthcare workers to our region was needed. In 2020, “Roseburg Family Medicine Residency” was launched. Since 2020, the program brought cohorts of eight residents to our community each year. The inaugural class of 2020 graduated from the program in June of 2023, with four of the eight physicians remaining in Oregon, two right here in Douglas County. This innovative, collaborate approach to creating a healthcare workforce training pipeline contributes to the economic health and the “actual” health of our community.

Congratulations to all our 2023 honorees, the recognition is most deserved!

For photos of our award winners, please visit the Roseburg Area Chamber’s Facebook and Instagram pages!

Archived News (12/31/2024)

Chamber Files Amicus Briefs with U.S. Supreme Court

Briefs Support Two United States Supreme Court Petitions for Certiorari

UPDATE 3/25/24: U.S. Supreme Court Denies Petitions

On December 14, the Roseburg Area Chamber of Commerce filed a Brief of Amici Curiae in support of petition for certiorari filed by petitioners in Murphy Company, et al v. Joseph R. Biden, Jr., in his official capacity as President of the United States, et al (No. 23-525). On Friday, December 15, the Roseburg Area Chamber of Commerce filed a Brief of Amici Curiae in support of petition for certiorari filed by petitioners in American Forest Resource Council, et al v. United States of America, et al (No. 23-524).

Amicus curiae literally means “friend of the court;” an individual or organization that is not a party to a particular case, but which has interest in the case or information related to a case of critical importance to their community(ies). The chamber’s filings are founded in its long-standing interest and advocation for active management of public forestland for all designated purposes mandated under the O & C Act of 1937. The chamber is pleased and honored to have NFIB (National Federation of Independent Business) Small Business Legal Center join both briefs in support of said U.S. Supreme Court petitions. Read joint Press Statement.

To read the chamber’s Amicus Brief in the American Forest Resource Council, et al case CLICK HERE. To read the chamber’s Amicus Brief in the Murphy Company, et al case CLICK HERE.

There are numerous reasons underlying the chamber’s decision to file briefs in both of these cases. First, the chamber, representing the interests of its members and Douglas County businesses, has significant interest in the Cascade-Siskiyou National Monument Designation, the BLM’s 2016 Western Oregon Resource Management Plan and the impacts due to lack of effective management of O & C Act forestland. Specifically, the threat to the protectable interests of the chamber, its members and the Douglas County businesses for which the chamber advocates. Read full article HERE.

The US Supreme Court met on Friday, March 22, to discuss the requests by Murphy Co. and American Forest Resource Council to review the expansion of the Oregon monument into O&C Act lands. On March 25, they published their decision, and unfortunately the Court has decided to deny reviewing those cases. So the D.C. Circuit’s and Ninth Circuit’s rulings (which we don’t support) will stand. Order List (03/25/2024) (supremecourt.gov)

If there is a sliver of good news, it’s that two Supreme Court justices – Justices Gorsuch and Kavanaugh, whom we cited purposefully and visibly in our brief because we hoped they would carry the matter forward into review for us – did want to review the cases. They “dissented” from the fuller Court’s refusal to review the cases.

Archived News (12/31/2024)

Paid Leave Oregon Creates FAQ for Businesses

Oregon’s paid family and medical leave insurance program–Paid Leave Oregon (PLO)–has partnered with the Bureau of Labor and Industries (BOLI) to produce three documents to clarify how paid leave works with the Oregon Family Leave Act (OFLA), paid time off and job protections.

- OFLA/Paid Leave Common Questions features a list of common questions and answers about how OFLA and PLO work together.

- Job Protections Common Questions answers common questions about job protections under PLO. For example, employers must protect the jobs of people who take paid leave if they’ve worked for them for at least 90 days.

- Use of Paid Time Off, OFLA and Paid Leave Oregon explains employee and employer rights and obligations when an employee asks for earned paid time off (personal time, for example) when the employee takes protected leave under PLO, OFLA or both.

Archived News (11/6/2024)

2024 Candidate Endorsements

ELECTION UPDATE: Congratulations to each of the RACC-endorsed candidates below who all were successful in their election and re-election bids! In addition to our opposition to Measure 118, the Roseburg Area Chamber of Commerce has endorsed incumbents/candidates in two contested state legislative races and two contested Roseburg city council races.

The chamber does not endorse in every race unless there is a clear and compelling reason to do so.

There are a number of criteria considered in RACC’s candidate endorsements. Chamber leadership reviews voting records, responses to written questionnaires and conducts in-person interviews as part of the candidate review process. Our endorsements are, first and foremost, based on a candidate’s proven support of local businesses in alignment with the chamber’s pro-business positions.

These individuals have the chamber’s confidence and full support. The Roseburg Area Chamber of Commerce endorses:

Katie Williams for Roseburg City Council, Ward 1, Position 2

Katie Williams for Roseburg City Council, Ward 1, Position 2

Andrea Zielinski for Roseburg City Council, Ward 2, Position 2

David Brock Smith, Oregon Senate, District 1

David Brock Smith, Oregon Senate, District 1

Virgle Osborne, Oregon House of Representatives, District 2

Please cast your vote in support of our local businesses, by voting for RACC-endorsed candidates and voting NO on Measure 118!

Archived News (11/6/2024)

Measure 118 Updates!

Ballots for November’s general election will be mailed out next Wednesday, October 16. You are aware about the myriad of problems Measure 118 would create for Oregon businesses and citizens. Measure 118 proposes the largest tax increase in Oregon history, a tax on sales, including sales on utilities, food, insurance and medicine, to name a few. Our members can help get the word out to neighbors, customers, vendors, employees and friends.

Yard Signs, Business Window Signs, Rack Cards and More! The chamber has “NO on 118” yard signs available. If you/your business would like a sign, email me HERE! We have ordered business window signs and bumper stickers and will let you know when we receive them!

Measure 118 Toolkit is Available! The Defeat the Costly Tax on Sales Coalition’s Outreach Toolkit for employers and coalition members is available. The chamber recognizes that for many of our members, direct engagement in political activity of any kind – either through communication with your employees, your customers, or vendors – requires careful consideration. This toolkit is intended as a resource for interested members as you think of various ways to communicate about Measure 118.

If you are interested in receiving the toolkit and associated resource documents, CLICK HERE and we’ll email it to you. This type of grassroots connectivity is vitally important to defeat Measure 118.

New “NO on Measure 118” Ad is Launched! The coalitions’ newest TV ad highlights several ways in which Measure 118’s $6.8 Billion annual tax on sales would increase costs for basic necessities like utilities, home and car insurance, gasoline, internet service, medicine, food and health care. Watch the ad here.

In case you’ve missed it, check out the first ad here. It which features Joel Kelly, an organic food grower and small business owner in Milwaukie, who describes the negative impacts Measure 118 would have on small businesses in Oregon.

These ads are part of a comprehensive effort by the Defeat the Tax on Sales coalition to inform Oregon voters about the negative impacts of Measure 118, a massive tax on sales that would drive up costs for Oregon households and businesses.

What Others are Saying About Measure 118! Oregon chambers of commerce and business organizations are not alone in recognizing the harm this measure would cause if passed. The list of labor unions, businesses, social justice advocates, elected officials and newspaper editorial boards opposing the measure keeps growing. Here’s what just a few of them have to say:

- “A tax that raises the price of medicine, food and utilities, saps funding for essential services and sends that money as rebates to all residents – regardless of income or need – is a formula for chaos.” – Oregonian editorial board

- “Oregonians think they have no state sales tax, but residents will pay more as businesses pass their tax costs along to consumers in order to survive.” – Wall Street Journal editorial board

- “Don’t be fooled by Measure 118’s ‘tax rebate.’ You’ll pay for that windfall through higher prices on just about everything.” – Gresham Outlook

- “It’s a half-baked idea that could prove incredibly damaging.” – Yamhill County News-Register editorial board

- “Measure 118 will hurt firefighters and other frontline workers by reducing available public safety funds in state, county and municipal budgets.” – Oregon State Fire Fighters Council

- “Measure 118 would divert vitally needed funds from the state’s general fund, limiting access to resources that are vital for our communities, particularly communities of color who have been under-resourced. Measure 118 runs counter to our work to build the capacity of communities of color and will make it more difficult to achieve justice and equity goals.” – Coalition of Communities of Color

- “Measure 118 is a hot mess, and voters should reject it as inequitable and wasteful.” Tax Fairness Oregon

- “If passed, Measure 118 would push us to the breaking point. While other businesses may pass this tax on to consumers, independent oncologists cannot pass this on to our patients – nor would we want to.” – Dr. John Schuler, radiation oncologist

- “Measure 118 would threaten small businesses by imposing a $6.8 Billion tax on sales, the largest tax increase in Oregon history. It would drive up costs for basic supplies we need to run our business and force us to pass those costs onto our customers.” – Joel Kelly, small business owner

- “Measure 118 is another out-of-state and dangerous experiment that doesn’t align with the needs of Oregonians.” – Senate Minority Leader Daniel Bonham, R-The Dalles

- “I am opposed to this ballot measure. It may look good on paper, but its flawed approach would punch a huge hole in the state budget and put essential services for low-wage and working families at risk.” – Gov. Tina Kotek

- “Measure 118 would hurt seniors living on fixed incomes by increasing prices for housing, groceries and medications – none of which are exempted from this tax. The last thing our state needs is to send rebates to wealthy folks who do not need it at the expense of services supporting our most vulnerable Oregonians.” – Oregon State Council of Retired Citizens and the United Seniors of Oregon

Archived News (11/6/2024)

Seven Things to Know about Measure 118's Deeply Flawed $6.8 Billion Tax

Opposition to Measure 118 continues to grow as Oregonians learn about the damage this deeply flawed $6.8 Billion annual tax on the sale of goods and services would do to the state’s residents, businesses, economy and public services.

Here are some facts to keep in mind:

- Measure 118 is a tax on sales, not income or profit. This tax on gross sales applies whether a business makes a lot of money, has small margins or even loses money.

- Prices will go up. There’s no such thing as free money. Consumers will pay for this massive tax through higher prices as confirmed by the nonpartisan Legislative Revenue Office.

- Measure 118 is a “tax on a tax.” Unlike a traditional sales tax that happens once at the final sale, Measure 118’s tax on sales could apply at every step of the supply chain.

- Measure 118 makes Oregon businesses less competitive. Out-of-state farmers, manufacturers and others will have an immediate advantage because sales in their state won’t apply.

- There’s no guarantee anyone gets their “rebate.” Future legislatures could amend this law at any time, use the money for something else, or increase the tax rate.

- Measure 118 taxes sales on everything—including everyday necessities. There are no product exemptions, so this tax on sales would apply to everything from groceries to gas, and from insurance to medicine.

- A broad, bipartisan coalition opposes Measure 118. Democrats and Republicans, business organizations and labor unions—the growing list of those who oppose this deeply flawed measure is unprecedented.

Download the fastsheet. If you haven’t already, please visit NOonMeasure118.com to join our growing coalition and learn more about the effort to defeat this costly tax on sales.

Archived News (4/15/2024)

Luther & John are Roseburg First Citizens

At it March 23 annual awards dinner and meeting of the membership, the Roseburg Area Chamber of Commerce was honored to recognize Toby Luther and Dori John as Roseburg’s 2022 First Citizens. These two outstanding community leaders were acknowledged for their long-time dedication and volunteer service to our Roseburg/Douglas County community.

John was recognized for her service and commitment to area youth including serving on numerous program/project teams and the board of directors for both the Boys & Girls Club of the Umpqua Valley and YMCA of Douglas County. Other community involvement includes Future Business Leaders of America, youth sports and music programs, Umpqua Bank regional board and previous tenure on the Roseburg Area Chamber board of directors, serving as board chair in 2015. Dori is general manager of Roseburg Disposal.

John was recognized for her service and commitment to area youth including serving on numerous program/project teams and the board of directors for both the Boys & Girls Club of the Umpqua Valley and YMCA of Douglas County. Other community involvement includes Future Business Leaders of America, youth sports and music programs, Umpqua Bank regional board and previous tenure on the Roseburg Area Chamber board of directors, serving as board chair in 2015. Dori is general manager of Roseburg Disposal.

Luther served as Roseburg Chamber board chair in 2018. His community service includes serving on the boards of Mercy Medical Center, Wildlife Safari and The Ford Family Foundation, for which he is the current board chair. He is actively involved with Umpqua Valley Christian School, Covenant of Life Fellowship and numerous industry organizations and councils. His wide and varied volunteer activities include past service with the Riverside Center, Umpqua Community Health, the United Way, Cap Ripken, UCC Strong and the turf project for Legion Field, to name a few. Toby is president and CEO of Lone Rock Resources.

We are a better, more fortunate community because of the two generous, dedicated and community-minded individuals. For a list of all the Roseburg Area Chamber’s First Citizens HERE.

Archived News (4/15/2024)

Chamber Recognizes Business Excellence for 2022

At it March 23 annual awards dinner and meeting of the membership, the Roseburg Area Chamber of Commerce recognized four local organizations for business excellence.

The chamber’s 2022 “Small Business of the Year” award went to Cascade Community Credit Union. Cascade Community Credit Union began as DougCo Schools Credit Union in 1928; a credit union for the educators of Douglas County. This small charter was made up of 15 educators who kept the sum of their assets in a shoebox locked in a closet. Starting as an institution of educators shaped Cascade’s values to this day. Their priorities lie in helping our community make informed decisions best for their needs. Those educators also created a culture that believed serving locally is how we help our community grow. Over the years, credit union began to serve Douglas County as a whole and merged with other institutions to form Cascade Community Credit Union. Their name changed, but their ideals never did. Cascade Community Credit Union continues to serve teachers, farmers, ranchers, business members and the families of Douglas County. Cascade Community Credit Union, celebrates 75 years of service this year, and it all started with 15 teachers and a shoebox.

Honors for the chamber’s 2022 “Medium-Size Business of the Year” went to Douglas Electric Cooperative. In 1936, Congress acted to remove rural areas from the “Dark Ages” by creating the Rural Utilities Service (RUS), formerly the Rural Electrification Administration (REA). Initially, low-interest REA loans were made available to commercial power companies for the purpose of electrifying rural areas. When the power companies failed to take advantage of REA loans, the agency turned to providing loans to locally-owned electric cooperatives. On September 7, 1939, West Douglas Electric Cooperative began supplying power to 209 members. On July 15, 1941, North Douglas Electric Cooperative began supplying power to 125 members. A merge of the two young cooperatives was ratified on June 20, 1942, to form the present day Douglas Electric Cooperative. Douglas Electric Cooperative (DEC) is a private, not-for-profit electric utility owned by the members it serves. It was established to provide its members with the most reliable electric service at the lowest possible cost. DEC serves just over 11,000 meters in a service area that covers 2,500 square miles in western and northern Douglas County, with small portions in northeast and southeast Coos County and south Lane County, excluding the city of Drain. Douglas Electric is a small cooperative made up of less than 40 employees. The folks at Douglas Electric are our neighbors, friends and family who are dedicated to serving the people of Douglas County, with consistency, integrity and hard work for more than 80 years, and they are proud to call Douglas County home.

Con-Vey was recognized as the chamber’s 2022 “Large Business of the Year.” Con-Vey opened its doors over 75 years ago as a fabrication and machine shop focusing on repair work for the local wood mills. Since their beginnings in 1946 as Keystone Machine Works, the company has shifted and combined forces with manufacturing professionals to become the world-class solutions company for industrial equipment. From steel fabrication to robotic automation, customers know they can go to Con-Vey for high-quality products at a competitive price. Con-Vey’s commitment to innovation has facilitated their expansion into material handling and robotics for building products, automation technology, bulk and biomass handling, environmental projects and agricultural processing. Con-Vey prides itself on handling demanding projects, creating innovative custom machinery and integrating effective solutions for its customers. Today, Con-Vey is a proven, high-quality supplier with proprietary machinery in nearly 20 countries. Con-Vey is a significant supporter of local youth education and building awareness of our manufacturing sector, which ultimately supports many local businesses and industries.

The Roseburg Area Chamber of Commerce annually honors member businesses that have made a substantial contribution to the community for the last five years or longer; have employees who individually or collectively participate in the community; and/or, the physical presence of the business adds to the economic vitality and livability of our community. All three of our 2022 “Business of the Year” recipients, are organizations that even during a time of unprecedented uncertainty due to the pandemic, related shutdowns and post-pandemic impacts didn’t waiver in their commitment to innovate. Despite any challenges they remained focused on growth, building new or renovating existing facilities and expanding their operations; investing in their organizations, employees and community. These companies’ commitment and investment contributes to the economic vitality of Roseburg and Douglas County.

In the final business recognition of the evening, the chamber presented an award that is not given out every year. The 2022 “Business Excellence in Innovation,” went to Con-Vey subsidiary 7robotics. This award recognizes “a business who exceeds the standard for resourcefulness and creativity in the workplace and has significantly improved the operating environment through the development and implementation of an innovative product, process, technology, or service.” 7robotics was started in 2019 by the team at Con-Vey. As a longtime integrator for robotic and automated systems in the wood products industry, Con-Vey’s extensive background and expertise acted as a springboard for 7robotics to enter into new markets and processes. Con-Vey’s 7robotics takes pride in collaborating with new customers and partners to create technology and automation solutions to fit the customers’ needs. The team at 7robotics uses their industry knowledge and perspective to create unique solutions to meet customer needs. They take pride in building relationships and collaborating with their customers and partners. They are continually improving and creating new innovative ways to serve their customers, community and employees.

For photos of our award winners, please visit the Roseburg Area Chamber’s Facebook and Instagram pages!

Archived News (2/5/2024)

Honoring Outstanding Businesses and Community Leaders

Nomination Deadline has Passed. The Roseburg Area Chamber of Commerce is accepting nominations for outstanding member businesses, 2023 first citizen honors and more. Honorees will be announced at the chamber’s annual awards dinner on March 21, 2024.

Business of the year recognition include three categories: small, medium and large-size Roseburg Area Chamber-member businesses. Check out our list of past recipients of business of the year honors. Criteria and additional details are included on the Business of the Year nomination form. The submittal deadline for nominations is February 2, 2024.

The chamber has opened 2023 nominations to honor deserving individuals with our community’s highest recognition, First Citizen. Take a look at the list of our past First Citizen honorees. The chamber is also accepting nominations for 2023 chamber volunteer and innovative business of the year. Nomination forms and criteria for these can be found online for Chamber Volunteer of the Year, Business Innovator and First Citizens. Email nomination form/packet to [email protected] by the 5:00 p.m. deadline on February 2, 2024 or mail (postmarked by February 2) to the Roseburg Area Chamber, P.O. Box 1026, Roseburg OR 97470.

Archived News (10/16/2023)

Lunch with Oregon's BOLI Commissioner

THIS EVENT HAS PASSED.

The Roseburg Area Chamber welcomes Oregon Bureau of Labor & Industries (BOLI) Commissioner Christina Stephenson to its October membership lunch. The Commissioner is interested in meeting with local business owners to hear about workforce challenges and other issues facing our business community, and share how the Bureau of Labor and Industries can be a resource for Oregon employers.

The Roseburg Area Chamber welcomes Oregon Bureau of Labor & Industries (BOLI) Commissioner Christina Stephenson to its October membership lunch. The Commissioner is interested in meeting with local business owners to hear about workforce challenges and other issues facing our business community, and share how the Bureau of Labor and Industries can be a resource for Oregon employers.

Chamber membership lunches are held from 11:45 am to 1:00 pm at the Douglas County fairgrounds. Advanced ticket purchase is required. Tickets are not sold at the door. The last day to purchase tickets and secure attendance is noon on Wednesday, October 11. The chamber’s October membership meeting luncheon is generously sponsored by Rogue Credit Union.

Archived News (9/1/2023)

Best Member Promotional Opportunity Closes End of Summer

AD RESERVATION DEADLINE IS CLOSED. The Roseburg Area Chamber of Commerce is currently accepting reservations for ads in its 2023-24 InUmpqua magazine–a digital and printed business directory, community profile and visitor guide. The InUmpqua is made available to residents and businesses throughout Douglas County, distributed to visitors and potential new residents and to chambers and visitor information center in Oregon. The online digital edition is one of the chamber’s most popular downloads.

AD RESERVATION DEADLINE IS CLOSED. The Roseburg Area Chamber of Commerce is currently accepting reservations for ads in its 2023-24 InUmpqua magazine–a digital and printed business directory, community profile and visitor guide. The InUmpqua is made available to residents and businesses throughout Douglas County, distributed to visitors and potential new residents and to chambers and visitor information center in Oregon. The online digital edition is one of the chamber’s most popular downloads.

This publication remains one of the best advertising values available to promote your business or organization to other businesses, residents and visitors. Check out our 2022-23 InUmpqua online or pick one up at the chamber! The reservation/contract submission deadline is August 31. CLICK HERE to download a copy of the 2023-24 InUmpqua rate sheet and advertising contract.

Archived News (9/1/2023)

Apply Now for Chamber's Distinguished Leadership Program

APPLICATION DEADLINE HAS PASSED. The chamber is currently accepting applications for its 2023-24 Project Leadership Roseburg program which starts September 14. The program curriculum and application packet is available online HERE.

The chamber is very proud of this long-standing program. Our 2023-24 Project Leadership Roseburg program will mark the 34th year of this distinguished program! Since its inception, the chamber has graduated nearly 650 future business and community leaders from its professional development program.

Not your typical leadership program, Project Leadership Roseburg provides participants with a comprehensive awareness of Douglas County and a deeper understanding of how our community works directly from our business and community leaders. The nine-month program shares knowledge about our city and county, and fosters dedication to our community as participants learn how to get involved through volunteerism to help create a more vibrant future for Douglas County.

Applicants may be either employer-sponsored or self-sponsored. The cost of the program is $750 for Roseburg Area Chamber members; $950 for non-RACC-members. Roseburg Area Chamber members are given admittance priority. Acceptance is on a first-submitted, first-approved basis. The application deadline is 5:00 p.m. on August 25, 2023.

Archived News (7/31/2023)

Make Our Douglas County Business Voice Heard

Members of our local business community will have two opportunities to make their voice heard with both federal and state elected officials.

(Event has Passed) April 21 at 5:00 pm–Public Input to the Oregon Legislative Joint Committee on Ways & Means. The Joint Ways & Means Committee will, for the first time be in Roseburg to take testimony directly from Douglas County citizens. This is an incredible opportunity for local business leaders to provide input on budget priorities for the state of Oregon’s upcoming biennial budget. This public input event will be held at Umpqua Community College in Jacoby Auditorium, 1140 Umpqua College Road on Friday, April 21 at 5:00 pm. Those wishing to provide testimony should register HERE!

(Event has Passed) April 6 at 1:00 pm–Douglas County Town Hall with Senator Ron Wyden and with Representative Val Hoyle. The town hall will be held in the Sutherlin High School gymnasium at 500 E Fourth Avenue in Sutherlin.

Archived News (7/31/2023)

Chamber Submits Testimony in Opposition to Oregon House Bill 3152

House Bill 3152 phases out the use of natural gas in the residential housing sector. It establishes that the policy of Oregon is to protect residential utility customers from risks of stranded fossil fuel assets and potential increases in energy burden while achieving state’s GHG emissions reduction goals. READ YOUR CHAMBER’S LETTER IN OPPOSITION TO HB 3152!

Archived News (7/31/2023)

Chamber Submits Testimony in Support of Oregon House Bill 3205

House Bill 3205 would exempt hiring and retention bonuses from the Equal Pay Act, giving Oregon businesses the tools they need to recruit and retain employees and keep local economies strong. READ YOUR CHAMBER’S LETTER IN SUPPORT OF HB 3205!

Archived News (7/31/2023)

Chamber Submits Testimony in Support of Senate Bill 795

Senate Bill 795 would allow Forest Trust Land counties to determine their own economic future. Forestlands were deeded to the state with the agreement that the lands would be actively managed for the economic benefit of the counties deeding the land. The state has failed to fulfill its part of the bargain. By returning control of the forestlands, counties would have the ability to manage the lands sustainably as a reliable source of revenue for its citizens. READ YOUR CHAMBER’S LETTER IN SUPPORT OF SB 795!

Archived News (7/31/2023)

Paid Leave Oregon . . . Is Your Business Prepared?

The chamber’s November membership meeting lunch program focused on Oregon’s new paid family and medical leave insurance program which starts January 1, 2023. Oregon employers, whether required to financially contribute or not, have mandated actions and responsibilities related to the “Paid Leave Oregon” program. Phillip Hudspeth, Outreach Program Analyst with the Oregon Employment Department presented our members with valuable information and resources at the November 14 lunch program. For those members unable to attend, Mr. Hudspeth provided the chamber with a copy of his presentation, CLICK HERE.

Following are links to additional resources and information about who is required to participate in the program, what information employers must provide to employees, what is an equivalent plan, deadlines and more.

Resources

Resource (most resources are available in up to 12 languages):

Model Notice – Needs to be posted prior to January 1, 2023

OFLA, FMLA, Paid Leave Comparison Chart

Contact Information

Paid Leave Oregon

PO Box 14151

Salem, OR 97311

833-854-0166

Website: paidleave.oregon.gov

Sign up for the Oregon Employment Department’s bulletin HERE.

Finalized Rules

The finalized statute can be found at Chapter 471, Division 70 “Paid Family Medical Insurance Leave” HERE.

Definition of wages are from 471-070-0400 to 471-070-0465

Archived News (6/30/2023)

Chamber Opposes ODF's Draft Habitat Conservation Plan

In a letter to the Oregon Board of Forestry, the Roseburg Area Chamber of Commerce addressed the numerous concerns it has with the Oregon Department of Forestry’s (ODF) draft Habitat Conservation Plan. READ YOUR CHAMBER’S LETTER REGARDING ODF’S DRAFT HCP.

Archived News (6/30/2023)

Chamber Launches "Job Board"

Have open positions with your company or organization? Of course you do! In early April, the Roseburg Area Chamber launched a new “Job Board” page on its website. Members of the Roseburg Area Chamber of Commerce with job/career openings can have those open positions posted on the chamber website.

Members may either email a PDF of the job description(s), their logo and/or a link to posting(s) on their company’s website to [email protected]. The chamber will share it on its “Job Board.” The chamber also links the Job Board from its “Move Here” page, which gets significant traffic from new residents and those interested in relocating to Roseburg and Douglas County.

Archived News (4/1/2023)

Four Receive Community's Highest Honor for Distinguished Service

Each year the Roseburg Area Chamber of Commerce has the immense privilege of recognizing community leaders who have, over many years, given selflessly of their talents, time, expertise, heart and so much more. On March 24, the chamber honored four such individuals. These outstanding First Citizens’ long-time dedication and distinguished service reflects their love for our community, and we are a better, more fortunate community because of them.

Celebrating our 2020 honorees, Sue Van Volkenburg and Steve Loosley and our 2021 honorees, Andrea Zielinski and Dave Leonard!

For details about the distinguished service of our 2020 and 2021 First Citizens, see the Press Packet for the chamber’s annual meeting of the membership and awards dinner. For a list of all our past First Citizens, CLICK HERE! Check out the chamber’s Instagram or Facebook pages for posts and photos of our 2021 Business of the Year honorees.

Archived News (4/1/2023)

Chamber Celebrates Business Excellence Recognizing 2021 Business of the Year Honorees

The Roseburg Area Chamber of Commerce recognized three local businesses as their 2021 businesses of the year, at the annual meeting of the membership and awards dinner on March 24.

The 2021 small business of the year award went to Gordon Wood Insurance & Financial Services. Douglas County Farmer’s Co-op was recognized as the chamber’s medium-size business of the year for 2021, with Lone Rock Resources celebrated as the 2021 large business of the year honoree.

Gordon Wood was founded in 1961 by Gordon Wood. Gordon Wood & Financial Services provides personal and business services to assist in planning for the future. The business is now owned and operated by Kelsey Wood, Gordon’s son. The chamber’s small business of the year, Gordon Wood Insurance was recognized for its integrity, reputation, long-standing commitment to serving clients and years….and years…of active involvement, of owners and employees, in our community. This local business, and when we say local, we mean local, from father to son to now a third generation working in the business, our small business of the year has been a recognizable name in the Roseburg/Douglas County community for over 60 years. Gordon Wood Insurance & Financial Services celebrated its 60th anniversary in 2021.

Our medium-sized business of the year is another home-grown, Douglas County business. Since 1921, Douglas County Farmers Co-op has been supporting and growing with the Douglas County community. The Co-op has had several names and moved around town (most noticeably after the Co-op was leveled in the 1959 Blast). Douglas County Farmers Co-op was once a small business with a pretty specific customer. Over the years, D.C. Farmers Co-op has grown in size, locations, product offerings and customer base, all while never forgetting their core clientele. Having celebrated its 100th anniversary last year, D.C. Farmer’s Co-op has been serving Douglas County ranchers, farmers and homeowners since 1921, and will continue to do so long into the future, especially with the anticipated completion and opening of a new location later this year. Their motto is, “Good people, good products, good advice.” But, let’s be honest, for many of us it’s all about spring time and the arrival of the baby chicks!

Our 2021 large business of the year, Lone Rock Resources, was founded by Fred and Frances Sohn. Fred emigrated from Germany as a young man in 1936, eventually making his way to the Pacific Northwest with wife, Frances. In 1950, the Sohns built a sawmill on the banks of the S Umpqua River. Fascinated with technology, Fred hired the best talent and used innovation to differentiate his company in the competitive world of post-World War II lumber manufacturing.

Over the next 50 years, Fred’s passion for innovation would change mill production worldwide. Taking the unprecedented step of assembling an electronics research team, Fred created the industry’s first fully computerized sawmill and later patented 3-D scanning technology to maximize log recovery. Today, every production mill in the world relies on that computer technology. Fred’s zeal for finding a better way extended to forest management as well. In the 1970s, the company aggressively began buying cut-over lands and restoring them, planting up to 1 million seedlings a year.

The 1990’s were a time of transition. Two of Fred’s five sons, Howard and Rick, moved into company leadership positions as the family and the company looked to the future. Continued investment in manufacturing was matched with significant additions to the forest land base. Company land holdings more than doubled over a 10-year period. Transitions continued as a new century began. In 2001, the Sohn family moved away from its manufacturing foundations selling it’s sawmill and veneer plant. Fred retired and his sons assumed leadership of the company focusing on its forest lands. The culture Fred established through investment in people, research, equipment, and technology remain integral to the company’s success today.

Rick Sohn’s retirement as president in 2008 marked a successful transition to non-family leadership. The board expanded to include directors with experience managing family businesses, as well as welcoming third-generation Sohn family members. Today under President and CEO Toby Luther, Lone Rock is a balanced and diversified real assets and natural resources investment company. This family-owned business is not only a standout leader in its industry, but the organization’s support of business, industry, local non-profit organizations; and, community and youth activities, is unparalleled. Lone Rock encourages its employees to be involved in our community resulting in the active participation with more than 40 local non-profit organizations, programs and events. During the 2020 Labor Day fires, this industry leader had 72 employees with nearly 7000 hours over 10 days, working to help contain the Archie Creek fire. Also deserving mention is Lone Rock’s aggressive diversification strategy, a diversification that added wine and Abby’s Pizza, under their already distinguished and respected brand.

Congratulations to our 2021 businesses of the years: Gordon Wood Insurance, Douglas County Farmers Co-op and Lone Rock Resources! Check out the chamber’s Instagram or Facebook pages for photos. For a list of all past recipients of the chamber’s Business of the Year recognitions, CLICK HERE!

Archived News (12/20/2022)

Grow Business With Exclusive Member-to-Member Program

Deadline to Participate in “Shop Chamber & Save” is December 16. There are many reasons why it is great to be a member of the Roseburg Area Chamber of Commerce. We live here…we work here…we play here…and, most importantly, we love this community.

Our members share a common goal, to see local businesses succeed. We can accomplish this together! One of the ways we do this is through out Shop Chamber & Save member-to-member discount program. Build clients, customers and relationships within our business community and support other member businesses by shopping locally.

To offer a chamber member-to-member discount in 2023, please download this flyer, fill it out and return it to the chamber. Call us if you have any questions!

Archived News (11/15/2022)

Economic Forecast 2023

Tickets are on sale now for Economic Forecast 2023. What can business expect in 2023? The November 14 program will take a look at the past year and the economic impacts on our businesses, our county and our state. Our presenters will explore current events and issues; the political climate; a few local industries having significant economic impact; and, share valuable information about trends to help members strategically plan for 2023.